Benefits Cliff Policy Concerns

This site is a project of Leap Fund, because we wished this had existed when we started doing research.

Policy Solutions That Have Made Impact.

We take inspiration from the ABLE program of accounts (from the Achieving a Better Life Experience Act of 2014 - and just look at this great video National State Treasuries created to promote ABLE!), the FSS program (Family Self-Sufficiency), and IDAs (Individual Development Accounts). Here in NYC, Scott Stringer’s childcare plan is yet another example of a city program aimed at improving benefits (in this case: childcare subsidies) as well.

Asset limits are a known contributor to benefits cliffs decisions and cliff-like loss.

The U.S. House Committee on Rules held a hearing on benefits cliffs October 2021.

Read our An Incomplete List of Proposed & Passed Legislation Dealing With Benefits Cliffs.

Overall Cliff Policy

Connecticut: Day of Action to raise awareness on benefits cliffs. Several General Assembly budget bills could have dealt with the issue but most failed, which inspired the action, a mock funeral procession to the governor's office to eulogize the bills, including the refundable Child Tax Credit, a housing voucher funding boost bill, and a bill eliminating the asset limit on the HUSKY C medical insurance program.

Missouri: SB45 Establishes a transitional benefits program for Temporary Assistance for Needy Families and the Supplemental Nutrition Assistance Program. The transitional benefits are designed to assist recipients of such programs whose monthly income has exceeded the maximum allowable income for program eligibility to continue receiving reduced benefits proportionate to the increase in income. [PASSED, 2023]

New England: Whole Family Approach to Jobs Initiative (6 state, ACF Region 1) and its benefit cliff learning community report about a variety of initiatives done at the state level to mitigate benefits cliffs [2024]

New Hampshire: HB4 Establishes a Benefits Cliff Effect Working Group to make recommendations to the Department of Health and Human Services (Department) in their effort to develop a plan to close the cliff effect, including the development and implementation of a benefits cliff calculator. Read progress on the group’s work here. [PASSED, 2019]

New Mexico: HM25 A House Memorial to reduce the cliff effect and end poverty is moving through the New Mexico legislature. [INTRODUCED, 2024]

New York: A05413 helps parents find and afford child care, building in graduated payments to address the benefits cliff [INTRODUCED, 2025]

Ohio: Childcare initiative aimed at addressing cliffs. Franklin County Commissioners voted to approve an additional funding to support the initiative which helps to make high-quality childcare more affordable for working families. [2024]

Rhode Island: H5998/S0791 Authorizing all health and human services programs to develop a sliding scale decrease in benefits as a beneficiary’s income increases beyond the current 250 percent federal poverty level. [PROPOSED, 2023]

Texas: Making Work Pay Act, HB1483 to solve benefit cliffs for SNAP and TANF [PASSED, 2019].

Policies that update access rules

Alaska: HB196 simplifies the SNAP process by enacting broad-based categorical eligibility with the aim for participants to work and save for the future without facing a benefits cliff [PROPOSED, 2023]

Alaska: SB149 Proposed SNAP expansion which would raise income thresholds and eliminate the asset test, based on the broad-based categorical eligibility (BBCE) policy of the federal government. [INTRODUCED, 2023]

Arkansas: HB1340 Requires the Department of Human Services to seek a waiver from the United States Food and Nutrition Service to exclude veteran disability benefits as income for eligibility determinations for SNAP. [PASSED, 2023]

Arkansas: SB306 Adjusted the SNAP asset limit for inflation. Directs the Department of Human Services to seek a waiver from the federal government to temporarily exempt Supplemental Nutrition Assistance Program enrollees from the current asset limits. [PASSED, 2023]

Connecticut: HB6114 addresses benefits cliffs in housing by excluding income from the children of applicants [PROPOSED, 2025]

Florida : HB121 Previously in Florida, families were eligible to receive Children’s Health Insurance Program (CHIP) benefits if their income was under 200% of that limit. Under the newly passed bill, as of January 1, 2024 families will continue to qualify for CHIP benefits until their income reaches 300% of the federal poverty limit, or $90,000 in 2023. The extended eligibility means that parents can earn more income—either through increased hours of work or career advancement—without triggering a "benefits cliff". [PASSED, 2023]

Indiana: SB334 Simplified application for SNAP benefits for people 60 years of age or older or people with a disability. Shortened the application form, reduced the number of verification requirements, and allowed individuals to waive recertification interview requirements. The Bill allows SNAP participants who certify or recertify for benefits under the simplified requirements to remain eligible for benefits for 36 months. [PASSED, 2023]

Indiana: HB1361 passed legislation so that those actively pursuing higher-paying jobs or workforce education and training don’t lose their government benefits solely because of an increase in their income. House Enrolled Act 1361 allows families who receive TANF to save up to $10,000 in additional assets and keep their benefits. [PASSED, 2022]

Iowa: HF 302 increases the income level at which families would lose eligibility for child care assistance, to address the benefits cliff, and establishes a graduated co-pay system where their contribution to their child care expenses as their income rises. [PASSED, 2021]

Nebraska: LB108 Change provisions relating to SNAP (increasing gross income limits) [PASSED].

Nebraska: LB1049 Raise eligibility levels for child care subsidies, to help Nebraskans transition to better work. [PASSED, 2021]

New Jersey: A1715 Extends the certification period to 12 months for SNAP participants and 24 months if all adult household members are elderly or disabled. [PASSED, 2023]

New York : A1288 Eliminates asset limits amount for any public assistance program. [PROPOSED, 2019, 2020]

New York: A4330 Relates to resource exemptions for applicants for public assistance programs; amends the Welfare Reform Act in relation to the effectiveness thereof. [PROPOSED, 2019, 2020]

New York: SB1353 Exempts certain income and resources provided to persons enrolled in certain pilot programs in determining eligibility for public assistance benefits. [PASSED, 2023]

Michigan: SB35 Bill amended the Social Welfare Act to remove the requirement that the Michigan Department of Health and Human Services (DHHS) apply an asset test to determine an individual’s financial eligibility for the Food Assistance Program (FAP). [PASSED, 2023]

Texas: HB1287 Allows for the exclusion of certain resources in determining eligibility for SNAP. Disregards from the SNAP asset limit up to $22,500 for an applicant or participant’s first vehicle and up to $8,700 for each additional vehicle. [PASSED, 2023]

Federal: HB7024 The bipartisan Child Tax Credit expansion would significantly benefit millions of children. See visuals on what would change for families. [ENGROSSED, 2024]

Federal: ASSET ACT, S3276 relates to eliminating asset limits on TANF, SNAP, and LIHEAP, and raising asset limits on SSI. [INTRODUCED, 2020]

Federal: S1371 Working Families Tax Relief Act, expands EITC and modifies child tax credit, increasing the amount and the portion that is refundable. [INTRODUCED, 2017]

Federal: End Child Poverty Act, H6598 End Child Poverty Act, introduced by Rashida Tlaib and Mondaire Jones, to tackles cliffs through tax code [PROPOSED, 2022]

Federal: The HOPE Act, H2336 reintroduced by U.S. Representative Joe Morelle and U.S. Senator Kirsten Gillibrand, to utilize updated technology to apply for multiple benefits at once [INTRODUCED, 2020, 2021]

Federal: SSI Savings Penalty Elimination Act, S4102 sponsored by Sen Rob Portman (R-Ohio) and Sherrod Brown (D-Ohio), read more about the bill reintroduced in 2023 [INTRODUCED, 2022, REINTRODUCED 2023]

Policies to conduct benefits and benefits cliff studies

Hawaii: HCR21 introduced a bill to study how to increase SNAP access, requesting that the study include options for addressing the benefits cliff. [INTRODUCED, 2024]

Kentucky: HB708, sponsored by Rep. Jonathan Dixon, requires the Cabinet for Health and Family Services to develop a proposal to make available a “benefits cliff” calculator to Kentuckians applying or reapplying for public assistance benefits, and creates a task force to study Kentucky’s benefits cliff issues. In 2024, HHS Delivery System Taskforce continues the Benefits Cliff Taskforce’s work [PASSED, 2022]

New York: S7743 Directs a study on the impact of increased minimum wage on eligibility for income based services, programs and subsidies. See results from 2023 proposal here. [INTRODUCED, 2020, 2023]

Pennsylvania: HM The legislation would direct the Joint State Government Commission to conduct a study and issue a report on the impact of benefits cliffs in Pennsylvania. House press release on Rep. Kenyatta’s benefits cliff legislation. [INTRODUCED, 2024]

West Virginia: S789 Introduced a bill to study Medicaid in the state, including provisions to report on strategies to mitigate the benefits cliff. [INTRODUCED, 2024]

Policies that provide income disregards

California: SB 609 The bill requires the Department of Social Services to include adult education and career technical education programs in the list of programs that are deemed to meet the SNAP employment and training exemption set by the federal regulations. [PASSED, 2023]

New York: A6709B Exempts certain income and resources provided to persons enrolled in certain pilot programs in determining eligibility for public assistance benefits, to establish a 6 month, 100% income disregard for New Yorkers receiving cash assistance and participating in job training, postsecondary education programs and unsubsidized and subsidized employment programs (see also this related bill) [PASSED, 2022]

New York: S6589A Senator Roxanne Persaud and Assembly Member Linda Rosenthal have introduced S6589/A7534, establishing a six-month, 100 percent income disregard for New Yorkers receiving cash assistance and participating in job training programs. [INTRODUCED, 2021]

* We’d like to give a shout out to National Conference of State Legislatures Benefits Cliff report, and The Women’s Fund of Greater Cincinnati did a fantastic roundup of state by state benefits cliff policy in 2019.

Policy Platforms Worth Knowing About

Hunger Free America: Fighting Poverty with H.O.P.E. – Health, Opportunity, and Personal Empowerment Accounts Streamline Economic Opportunity

CirclesUSA: #2 on their Policy Platform to resolve the cliff effect to ensure that working families do not lose essential public supports faster than they can earn income to replace them

Aspen Institute: Benefits21 is an initiative focused on creating and implementing an integrated, modernized system of benefits that ensures financial security and economic dignity for all workers

Women’s Fund of Greater Cincinnati: Survey of Legislation to Ameliorate the Cliff Effect

Episcopal Community Services of Philadelphia: Benefits Cliff as one of their key strategic pillars for advocacy

Policy That Exacerbates Cliffs.

Work requirements

The Center on Budget and Policy Priorities has already proven work requirements don’t work (2023 CBPP Report)

The Maven Collaborative and CLASP dove into the anti-blackness behind work requirements and their history, called Work Requirements Are Trash (2024 Maven Collaborative)

Trump Administration’s Food Stamp 3 Part Proposal: Work requirements are needlessly punitive (Example: 2020 WaPo, 2019 ThinkProgress, 2019 WaPo, 2019 KATU Oregon, 2019 KUNC Colorado)

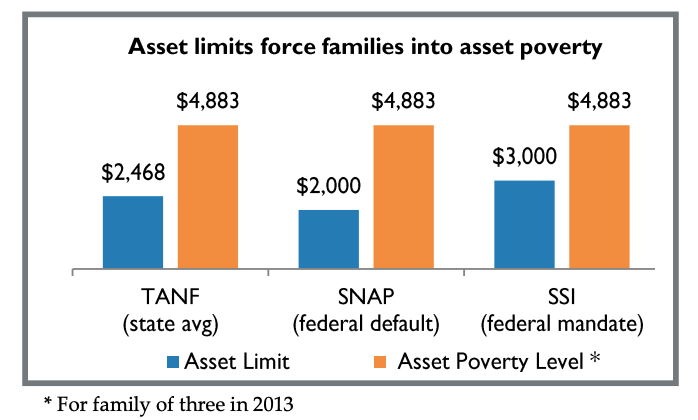

Asset/income limits

States can use broad-based categorical eligibility (BBCE) to raise SNAP income limits above the federal limit. A 2019 Trump Administration rule stripped this authority from states, reducing access for millions by limiting income to 130% of the poverty line – in 2019, $33,475 for a family of four (2019 Vox, 2021 Dallas News)

See Leap Fund’s article about the SSI Savings Penalty Elimination Act

Stricter asset limitations are needlessly punitive (Example: 2020 WaPo)

Direct cash

One time cash infusions can have unintended consequences (Example: 2020 COVID)

See also our Other Issues page under the section addressing Guaranteed Income (Basic Income) Programs

Public Charge

A policy change proposed in 2018 and published in August 2019 penalized immigrants who legally receive SNAP, parts of Medicaid, housing assistance and other public benefits (2018 Policy Tracker Report, Columbia University)

The Biden Administration passed a Final Rule, in effect as of December 2022, that undid many of the punitive changes of the 2018 Proposal. However, research shows that many noncitizens responded to the tightening rules by reducing use of benefits or services for themselves and their U.S.-born children, regardless of whether those benefits and services were included in the new criteria for public charge – a ‘chilling effect.’ Even groups exempt from public-charge assessments used fewer benefits. Confusion and fear over triggering negative consequences are keeping many from accessing benefits and services for which they are eligible (2022 Migration Policy Institute)